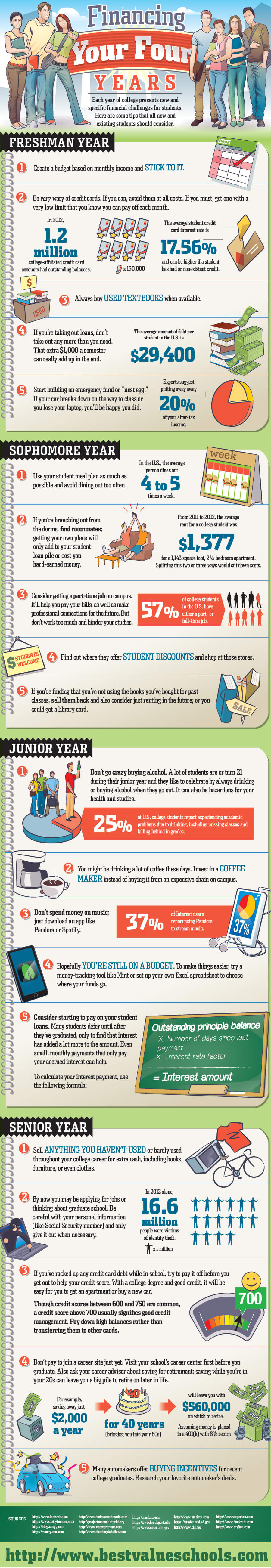

FINANCING YOUR FOUR YEARS

Share this infographic on your site!

[Box with the function to share the image]

Each year of college presents new and specific financial challenges for students. Here are some tips that all new and existing students should consider.

Freshman Year

1. Create a budget based on monthly income and stick to it.

2. Be very wary of credit cards. If you can, avoid them at all costs. If you must, get one with a very low limit that you know you can pay off each month.

In 2012, 1.2 million college-affiliated credit card accounts had outstanding balances. The average student credit card interest rate is 17.56%, and can be higher if a student has bad or nonexistent credit.

3. Always buy used textbooks when available.

4. If you're taking out loans, don't take out any more than you need. That extra $1,000 a semester can really add up in the end.

The average amount of debt per student in the U.S. is $29,400.

5. Start building an emergency fund or "nest egg." If your car breaks down on the way to class or you lose your laptop, you'll be happy you did.

Experts suggest putting away 20% of your after-tax income.

Sophomore Year

1. Use your student meal plan as much as possible and avoid dining out too often.

In the U.S., the average person dines out 4 to 5 times a week.

2. If you're branching out from the dorms, find roommates; getting your own place will only add to your student loan pile or cost you hard-earned money.

From 2011 to 2012, the average rent for a college student was$1,377 for a 1,143 square foot, 2 1/2 bedroom apartment. Splitting this two or three ways would cut down costs.

3. Consider getting a part-time job on campus. It'll help you pay your bills, as well as make professional connections for the future. But don't work too much and hinder your studies.

57% of college students in the U.S. have either a part- or full-time job.

4. Find out where they offer student discounts and shop at those stores.

5. If you're finding that you're not using the books you've bought for past classes, sell them back and also consider just renting in the future; or you could get a library card.

Junior Year

1. Don't go crazy buying alcohol. A lot of students are or turn 21 during their junior year and they like to celebrate by always drinking or buying alcohol when they go out. It can also be hazardous for your health and studies.

25% of U.S. college students report experiencing academic problems due to drinking, including missing classes and falling behind in grades.

2. You might be drinking a lot of coffee these days. Invest in a coffee maker instead of buying it from an expensive chain on campus.

3. Don't spend money on music; just download an app like Pandora or Spotify.

37% of Internet users report using Pandora to stream music.

4. Hopefully you're still on a budget. To make things easier, try a money-tracking tool like Mint or set up your own Excel spreadsheet to choose where your funds go.

5. Consider starting to pay on your student loans. Many students defer until after they've graduated, only to find that interest has added a lot more to the amount. Even small, monthly payments that only pay your accrued interest can help.

To calculate your interest payment, use the following formula:

Outstanding principle balance

X Number of days since last payment

X Interest rate factor

____________________

= Interest amount

Senior Year

1. Sell anything you haven't used or barely used throughout your college career for extra cash, including books, furniture, or even clothes.

2. By now you may be applying for jobs or thinking about graduate school. Be careful with your personal information (like Social Security number) and only give it out when necessary.

In 2012 alone, 16.6 million people were victims of identity theft.

3. If you've racked up any credit card debt while in school, try to pay it off before you get out to help your credit score. With a college degree and good credit, it will be easy for you to get an apartment or buy a new car.

Though credit scores between 600 and 750 are common, a credit score above 700 usually signifies good credit management. Pay down high balances rather than transferring them to other cards.

4. Don't pay to join a career site just yet. Visit your school's career center first before you graduate.

Also ask your career adviser about saving for retirement; saving while you're in your 20s can leave you a big pile to retire on later in life. For example, saving away just $2,000 a year for 40 years (bringing you into your 60s) will leave you with $560,000 on which to retire, assuming you placed it in a 401(k) with an 8% return.

5. Many automakers offer buying incentives for recent college graduates. Research your favorite automaker's deals.

Sources:

https://www.dailyfinance.com

https://money.cnn.com

https://www.entrepreneur.com

https://cms.bsu.edu

https://www.brockport.edu

https://www.niaaa.nih.gov

https://www.statista.com

https://studentaid.ed.gov

https://www.bjs.gov

Get prepared for your next steps

Use articles and resources to uncover answers to common questions, get guidance on your goals, and learn about applying to schools.

Discover a program that is right for you.

Explore different options for you based on your degree interests.